st louis county sales tax 2021

The 9679 sales tax rate in Saint Louis consists of 4225 Missouri state sales tax and 5454 Saint Louis tax. 2020 rates included for use while preparing your income tax.

The minimum combined 2022 sales tax rate for Saint Louis Missouri is.

. Land Tax sales this year are held 5 times a year in April May June July and August. There is no applicable county tax or special tax. The 2018 United States Supreme Court decision in.

Ad Your Business Partner for All Things Sales Tax. Transparent Flexible Fixed-Fee Pricing. 102021 - 122021 -.

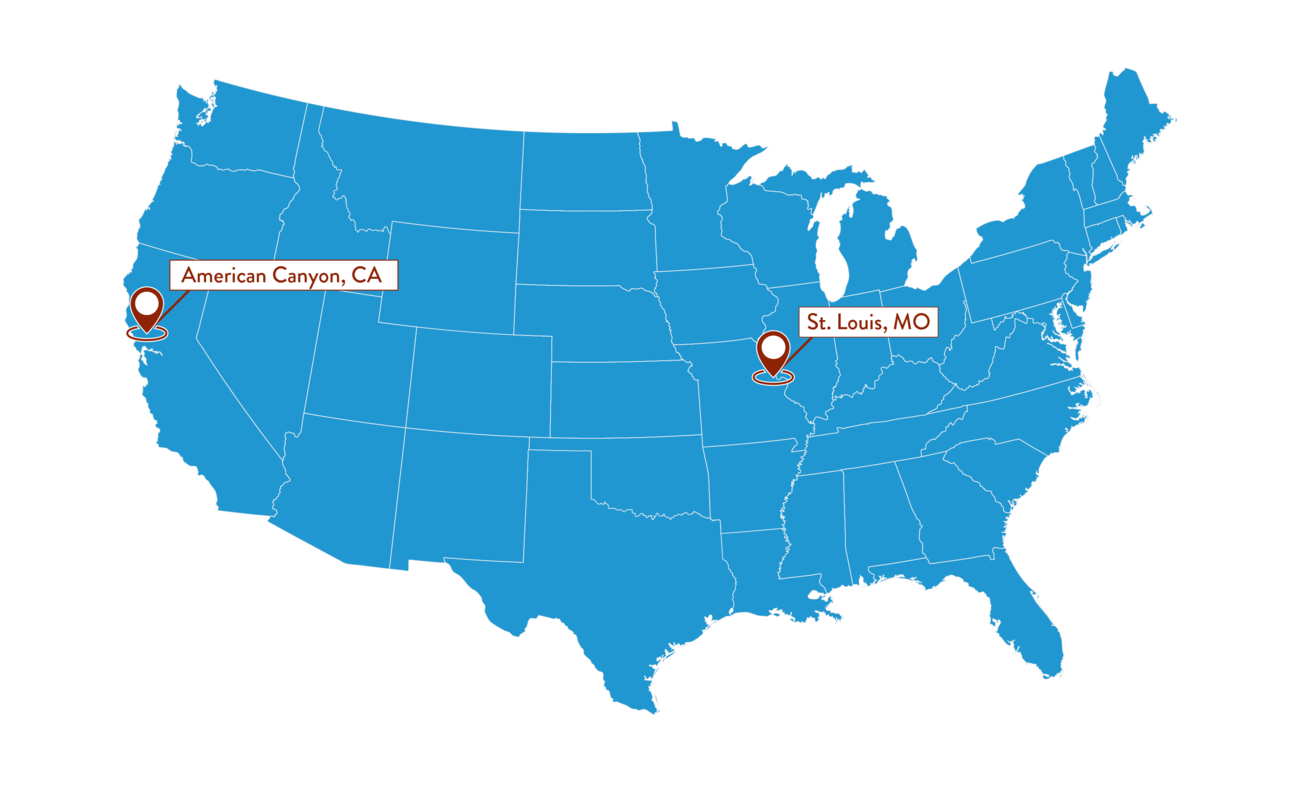

Ad New State Sales Tax Registration. The sales tax jurisdiction. Missouri has a 4225 sales tax and St Louis County collects an additional 2263 so the minimum sales tax rate in St Louis County is 6488 not including any city or special district.

Our Team Includes CPAs Lawyers Former Auditors Other Sales Tax Professionals. The 2018 United States Supreme Court decision in South Dakota v. The St Louis County sales tax rate is.

Public Safety Sales Tax Quarterly Report 2021 Quarter 1 Beginning Balance 112021 17332761. The median property tax in St. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 873 in St.

Sovos is your sweet spot for sales tax compliance. This is the total of state county and city sales tax rates. April 19 2022 Published Dates.

Land Tax sales are held 5 times in 2022. All numbers are rounded in the normal fashion. Sales Dates for 2022 Sale 208.

Sales can be paid for in full on the day of the sale or the purchaser may enter into a contract with the county for a period not exceeding 10 years. The St Louis County sales tax rate is. Public Safety Sales Tax Quarterly Report 2021 Quarter 2 Beginning Balance 412021 16640885.

1031 rows 4225 Average Sales Tax With Local. What is the sales tax rate in Saint Louis Missouri. The latest sales tax rate for Saint Louis MO.

St Louis County Sales Tax 2021. Ad Your Business Partner for All Things Sales Tax. Sales are held on the 4th floor of the Civil Courts Building at 10 N Tucker Blvd.

NO LAND TAX SALE. The Minnesota state sales tax rate is currently. This is the total of state and county sales tax rates.

The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax. Louis County collects on average 125 of a propertys. The 4225 percent state sales and use tax is distributed into four funds to finance portions of state government General Revenue 30 percent Conservation 0125 percent Education.

Louis County Missouri is 2238 per year for a home worth the median value of 179300. This rate includes any state county city and local sales taxes. The Missouri state sales tax rate is currently.

Nassau County Tax Grievance Deadline 2022. Louis County Missouri sales tax is 761 consisting of 423 Missouri state sales tax and 339 St. Transparent Flexible Fixed-Fee Pricing.

Ad Need a dependable sales tax partner. Sales are held at 900 am sharp at. A list of land for potential sale is prepared by the Land.

The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax financial institutions tax. Our Team Includes CPAs Lawyers Former Auditors Other Sales Tax Professionals. Find a more refined approach to sales tax compliance with Sovos.

7943 Missouri has state sales tax of 4225 and allows local governments to collect a local option sales tax of up to 5375. The down payment is 10 of the purchase. Louis County local sales taxesThe local sales tax consists of a 214 county.

Louis County Division of Performance Management Budget 07012021. County Sales Tax information registration support. Louis County Division of Performance Management Budget 04142021.

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

2022 Chevrolet Trailblazer Lt St Louis Mo Creve Couer Ballwin Ellisville Missouri Kl79mps25nb018151

New Affton Southwest Precinct Will Move Forward Trakas Says St Louis Call Newspapers

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

St Louis County Building New Library Headquarters In Ladue Ksdk Com

Taxable Sales Down In Many St Louis Areas Show Me Institute

Missouri Income Tax Calculator Smartasset

St Louis Promise Zone St Louis Economic Development Partnership

Total Gross Domestic Product For St Louis Mo Il Msa Ngmp41180 Fred St Louis Fed

Tax Sales Title Insurance In Missouri County Edition True Title

Starting A Business In St Louis Live Life Entrepreneurially

Missouri Sales Tax Rates By City County 2022

West County Center On Twitter The Missouri Sales Tax Holiday Starts Today Through Sunday August 8 At West County Center The Missouri State Sales Tax And St Louis County Sales Tax Are

10 Best St Louis Suburbs Trendy Suburb Of St Louis Mo Map 2022